Introduction to Budget Planner Apps

Budget planner apps have revolutionized personal finance management, offering a digital alternative to traditional budgeting methods. These applications streamline the process of tracking income and expenses, allowing users to gain greater control over their financial well-being.

Definition and Key Features

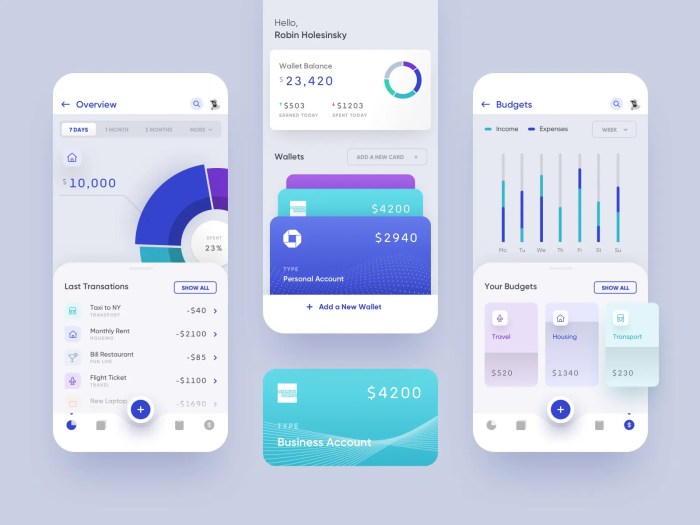

A budget planner app is a software application designed to help users manage their finances by tracking income, expenses, and creating budgets. These tools typically provide a centralized platform for recording transactions, categorizing expenses, and visualizing financial data.

- Income Tracking: Allows users to input their various sources of income, enabling a clear overview of their total earnings.

- Expense Categorization: Helps users categorize expenses into different categories (e.g., housing, food, transportation) to identify spending patterns and areas for potential savings.

- Budgeting Tools: Enable users to set budgets for different categories and monitor adherence to their predefined spending limits.

- Reporting and Visualization: Present financial data in various formats (charts, graphs, reports) to provide insights into spending habits and financial health.

Types of Budget Planner Apps

Budget planner apps cater to diverse needs and preferences, offering varying levels of functionality and features.

- Basic Apps: These apps typically offer core functionalities like income and expense tracking, and basic budgeting tools.

- Premium Apps: These apps provide more advanced features such as investment tracking, financial analysis, and personalized financial planning advice.

- Apps with Specific Needs: Some apps cater to particular needs, such as student loan management, or family budgeting.

Evolution of Budgeting Tools

The journey from physical budgeting methods to digital platforms reflects a continuous evolution in financial management.

- Physical Methods: Traditional methods involved using notebooks, spreadsheets, or budgeting apps to track income and expenses. This often proved cumbersome and time-consuming.

- Digital Transition: The rise of personal computers and mobile devices paved the way for digital budgeting tools, which offered improved data management and analysis capabilities.

- App-Based Solutions: Budget planner apps built upon the digital foundations, providing a more user-friendly and comprehensive approach to financial management.

Outcome Summary

From basic income and expense tracking to advanced financial analysis and investment management, budget planner apps are transforming how we approach personal finance. This exploration highlights the crucial role of user-friendly design, integration with other financial tools, and the ongoing evolution of these applications. Choosing the right app depends on individual needs and preferences, but the potential for improved financial well-being is undeniable. By understanding the diverse features and functionalities, users can leverage these apps to achieve greater control over their finances and build a secure financial future.