Navigating the complexities of personal finance can be daunting. Financial advisor apps are emerging as powerful tools, offering personalized guidance and accessible resources to help users take control of their financial well-being. From budgeting and investment strategies to tax planning and retirement planning, these apps are streamlining the process of managing your money.

This comprehensive overview explores the evolution of financial advisor apps, delving into their user interfaces, key features, target demographics, integration with other financial services, security protocols, pricing models, and future innovations. The aim is to provide a clear understanding of the current landscape and future potential of these innovative platforms.

Introduction to Financial Advisor Apps

Financial advisor apps are digital platforms designed to provide personalized financial guidance and support to users. These apps leverage technology to streamline financial management tasks, offer diverse investment options, and provide users with tailored advice. They range from basic budgeting tools to complex investment strategies, catering to a wide spectrum of financial needs and knowledge levels.

Types of Financial Advice Offered

Financial advisor apps offer a variety of services, from basic budgeting and expense tracking to more complex investment strategies and comprehensive financial planning. They often provide advice on topics such as:

- Budgeting and expense tracking

- Investment portfolio management

- Retirement planning

- Tax planning

- Debt management

- Insurance recommendations

Key Features Differentiating Apps

The key features that distinguish one financial advisor app from another include:

- Investment tools: The sophistication of investment tools, such as the range of investment options offered and the level of portfolio customization, vary significantly.

- Budgeting and expense tracking: Some apps provide basic budgeting tools, while others offer more comprehensive budgeting and expense tracking features, potentially with integration with bank accounts.

- Financial planning: Apps vary in their depth of financial planning capabilities, from basic retirement planning to more complex models involving various life events and goals.

- Customer support: The quality and availability of customer support can significantly impact user experience.

- Security features: The implementation of security protocols and data encryption measures is crucial for user trust and protection.

Comparison of App Platforms

| App Platform | Budgeting | Investment | Tax |

|---|---|---|---|

| Basic Budgeting App | Basic expense tracking, limited budgeting tools | Limited investment options, basic portfolio visualization | Limited tax information, no tax planning |

| Advanced Financial Planning App | Comprehensive budgeting, expense tracking, and financial goal setting | Wide range of investment options, advanced portfolio management tools | Tax planning, tax optimization, and compliance support |

| Investment-focused App | Basic budgeting, but primarily focused on investment portfolio management | Highly sophisticated investment tools, advanced charting and analysis | Limited tax features, typically integrated with tax software |

User Experience and Interface

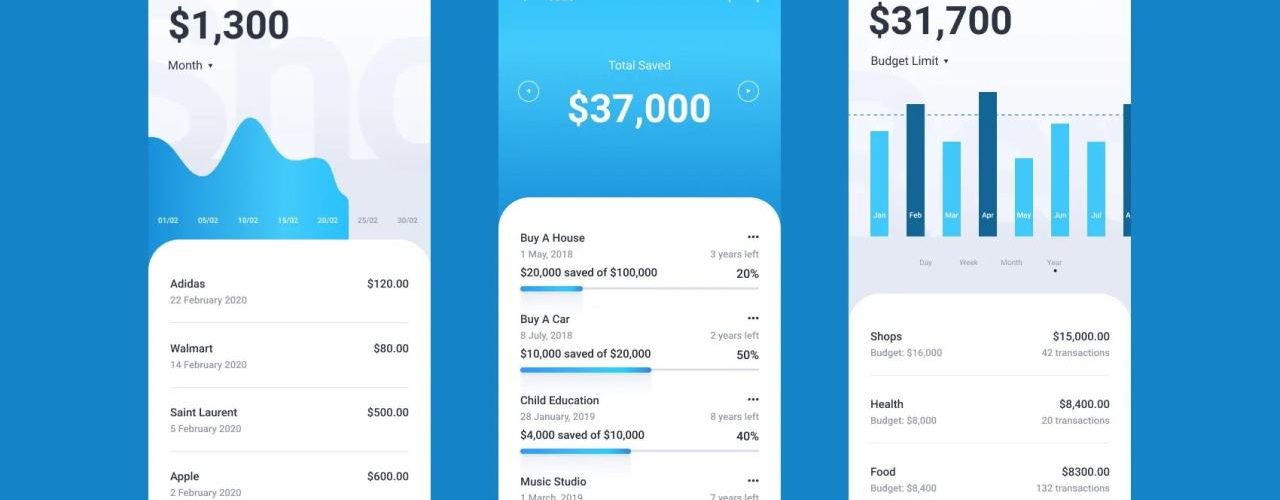

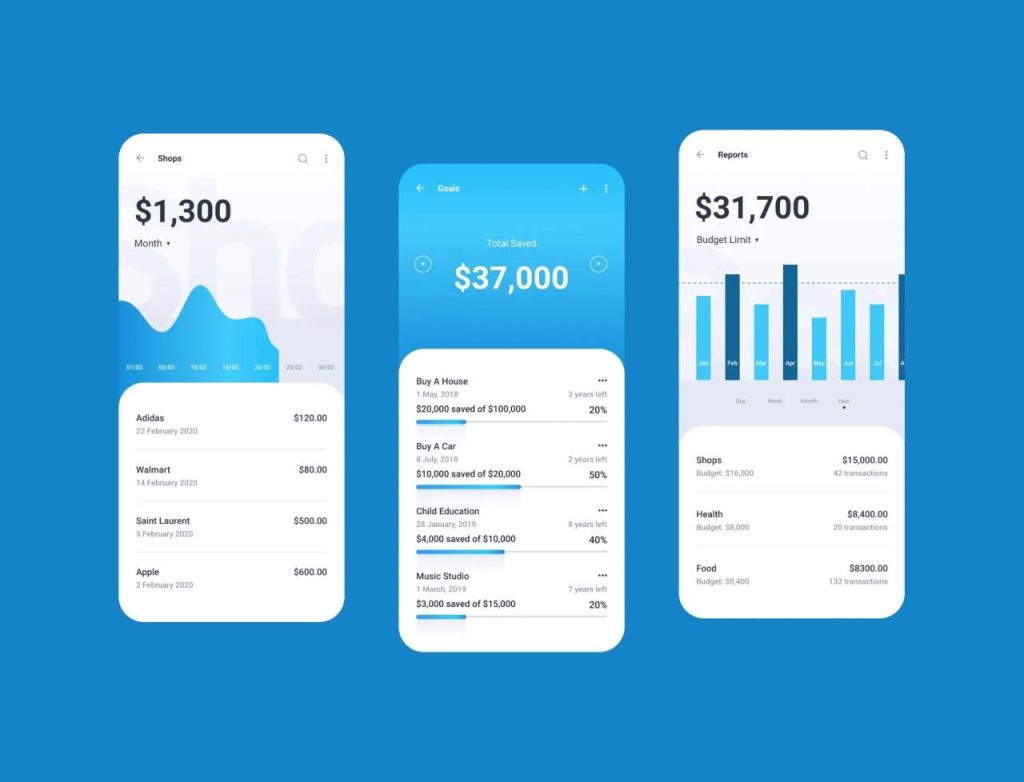

A user-friendly interface is crucial for financial advisor apps, as users need to easily access and understand complex financial information. Clear visual representation of data and intuitive navigation are essential for engagement and effective use.

Elements of a User-Friendly Interface

- Intuitive navigation: A simple and logical structure that allows users to quickly find the information they need.

- Visual appeal: Visually appealing and easily digestible data presentation. This includes charts, graphs, and clear visualizations of financial data.

- Accessibility: Features that make the app accessible to users with disabilities, such as adjustable font sizes and color schemes.

- Clear language: Using straightforward and understandable language to explain financial concepts and terms.

Presenting Complex Financial Information

Complex financial information should be presented in a clear and accessible format, using visualizations and explanations to make the information understandable. Avoid jargon and technical terms whenever possible.

User Interface Design Approaches

| Design Approach | Pros | Cons |

|---|---|---|

| Minimalist Design | Clean, uncluttered interface, easy to navigate | May not be suitable for complex financial information |

| Detailed Design | Comprehensive information, clear visualizations | Can be overwhelming for some users |

| Interactive Design | Engaging user experience, dynamic data visualization | May require more technical expertise from the developers |